Australian house prices could increase by up to 6% next year if interest rates drop, according to new forecasts.

A persistent housing shortage, combined with steady demand, is expected to drive price growth in 2025. However, the pace of growth may slow as buyers face affordability challenges.

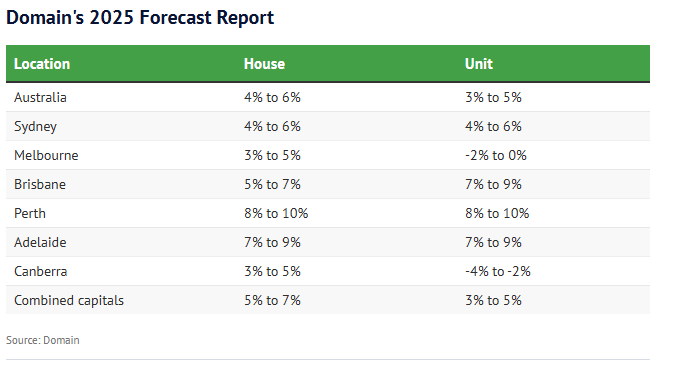

According to Domain’s 2025 Forecast Report, house prices across the country are expected to rise by 4% to 6% next year.

Sydney’s house and unit prices are predicted to align with the national average, while Melbourne may see slightly slower growth, with house prices increasing by 3% to 5%. However, Melbourne unit prices are expected to remain flat or even drop by up to 2%.

Perth is forecast to outpace the rest of the country, with house and unit prices projected to climb by 8% to 10%.

Adelaide is expected to see house and unit prices rise by 7% to 9%.

In Brisbane, house prices are forecast to grow by 5% to 7%, while unit prices could increase by 7% to 9%.

According to Domain’s chief of research and economics, Dr. Nicola Powell, 2025 will be a year of two distinct market phases.

“We’re expecting the pace of growth to slow,” Powell said. “Prices are already losing momentum, and this trend is likely to continue into 2025.”

She explained that weaker market conditions are expected in the first half of the year, mainly because many buyers are holding back.

Most of the projected property price growth, she noted, is expected in the second half of 2025 when interest rates are anticipated to drop.

“If inflation stabilizes, the cash rate decreases, and Australians feel more confident about the economy, it will encourage buyers to return to the market,” Powell added.

She also emphasized that rising property prices across much of Australia in 2025 will be driven by a severe housing shortage, challenges in the construction industry, and strong demand for homeownership.

Prices in smaller capital cities like Perth, Brisbane, and Adelaide are expected to see stronger growth as more buyers seek affordable options in these markets. Similarly, the lower-end housing markets in Sydney and Melbourne are likely to grow, driven by an increase in first-home buyers benefiting from the federal government’s Help to Buy scheme, which was approved last week.

Domain’s forecast aligns closely with those of the major banks. NAB predicts home values in capital cities will rise by 4.2% next year. Westpac forecasts a 3% increase, CBA expects 5%, and ANZ anticipates growth of 5% to 6% for homes across Australia.

ANZ senior economist Adelaide Timbrell highlighted that mid-sized cities will drive this growth.

“We’ve seen a population surge in mid-sized cities like Brisbane, Adelaide, and Perth, creating significant momentum in housing markets,” Timbrell said. “The demand for homes has far exceeded the number being built.”

Sydney, as the country’s most expensive property market, is expected to see price growth, boosted by the two rate cuts ANZ has forecast for next year.

“This increases borrowing capacity—when people can borrow more, they can bid higher,” explained an expert.

She also noted that recent income tax cuts and wage growth exceeding inflation will further support this trend.

“In 2025, wages are growing faster than inflation, meaning people will generally have more disposable income after covering essentials. This strengthens borrowing power, complemented by the tax cuts.”

Commonwealth Bank’s head of Australian economics, Gareth Aird, predicts a 5% rise in national property prices in 2025, assuming the Reserve Bank of Australia begins its rate-cutting cycle.

However, Aird expects outcomes to vary across regions.

“In Sydney and Melbourne, prices have recently dipped slightly,” he said. “Sydney’s prices are adjusting from very high levels, while Melbourne’s market has been more affordable for the past year.”

Read More : Albanese Government Plan Removes Surcharge Fees